Reach a highly engaged audience of AEC innovation leaders, executive teams, and industry titans. Check out our media kit.

INDUSTRY INSIGHTS

3D Printing is Back: $62M Contracts, Growth, and the Real Opportunity

Standards-based validation has unlocked a new phase. Here's what happens now.

Two years ago, Icon laid off staff. Mighty Buildings went into administration. The narrative was simple: 3D printing in construction was failing.

Today, the military is writing $62M contracts for barracks. Multi-story residential projects are under construction. Specialized infrastructure is being deployed. The narrative has shifted entirely.

What actually changed between 2024 and 2026? According to Stephan Mansour, a construction veteran with 20 years in major projects and now focused on standards development in the sector, the answer isn't what most people think.

It wasn't the technology. The machines work roughly as they did two years ago. No sudden breakthrough in materials or capabilities.

The shift was structural. The construction industry finally built the validation framework that had been missing all along. Insurance companies can now underwrite projects. Regulators can approve structures. Government agencies are confident enough to contract for deployment.

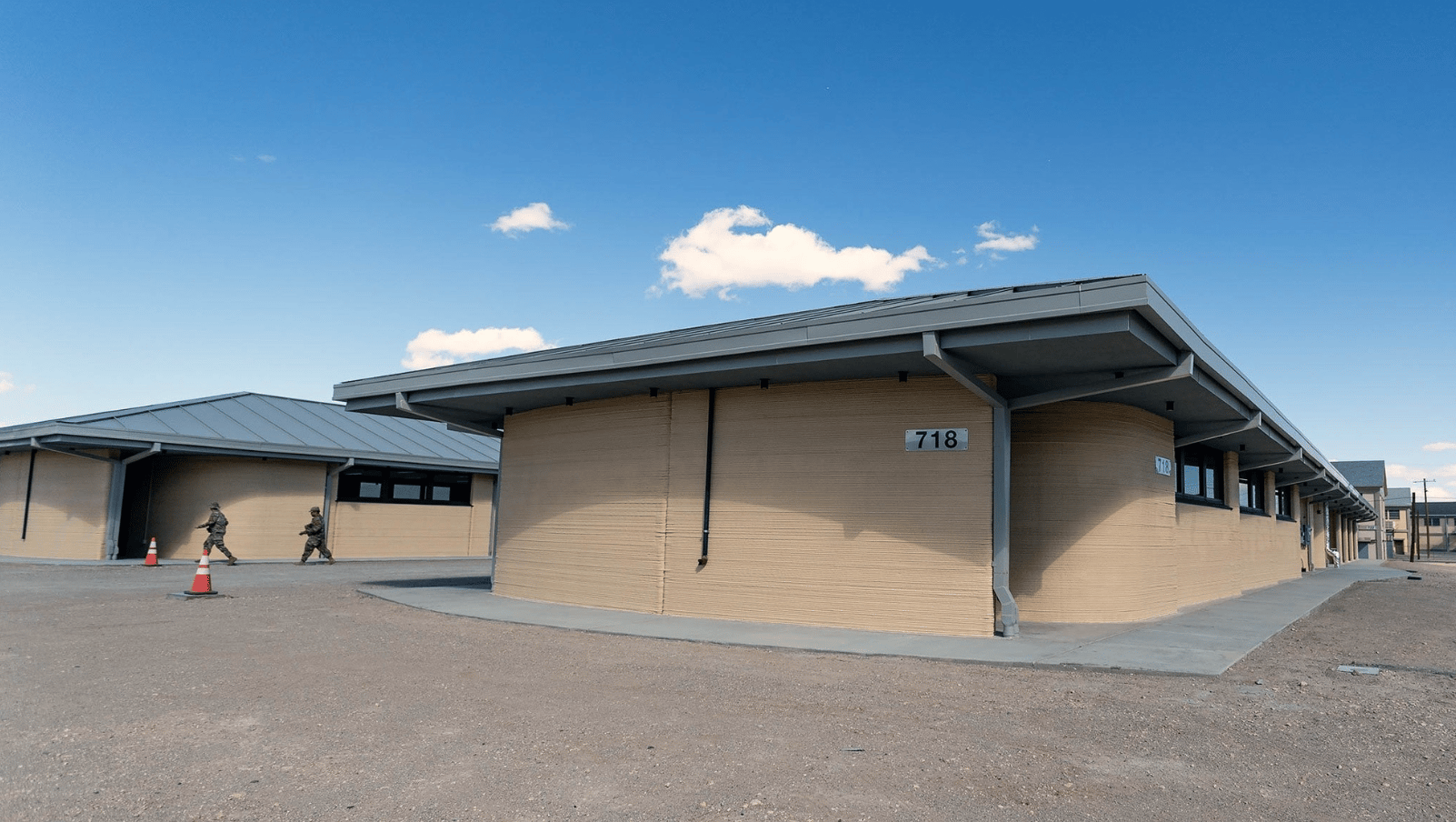

That's why Fort Bliss matters more than Icon's layoffs. One signals a technology. The other signals market structure. And market structure is what actually drives adoption.

TL;DR: Additive Construction Is Real Now

The 2024 “collapse” wasn’t a tech failure. It was a lack of standards, insurance, and regulation.

Those standards now exist, unlocking insurance, permits, and $62M government contracts.

That’s why Fort Bliss matters more than startup layoffs: market structure drives adoption.

The industry has matured from “3D printing” to “additive construction.” Language matters.

It doesn’t replace labor; it shifts workers to safer, higher-value tasks.

Use cases are now clear: military, housing, infrastructure, and custom components.

Economics are application-specific, not universal.

The real question in 2026 isn’t “does it work?” but “does this solve my problem?”

Bottom line: Additive construction is validated, boring, and practical — which is exactly why it’s finally happening.

Why The 2024 Crash Made Sense

When Icon faced headwinds in 2024, the narrative seemed clear: 3D printing wasn't ready. But that missed the real issue.

These companies faced a market structure problem, not a technology problem.

According to those working in the space, the problem was structural. As Stephan puts it, "The construction industry requires assurance of better results before it adopts innovation." You can't build that assurance with technology alone. You need standards, regulatory frameworks, and insurance underwriting.

Construction doesn't adopt tools it doesn't understand. It doesn't finance unproven methods. Insurance won't underwrite unvalidated approaches. Regulators won't approve structures without frameworks.

By 2024, 3D printing companies had technology but lacked the scaffolding that enables adoption.

The Standards Breakthrough

The conversation shifted in late 2024. Instead of debating whether 3D printing could work, the industry focused on standards.

A framework was published in December 2023 after 2.5 years of work. It specified material behavior, extrusion tolerances, structural performance, and safety protocols.

Standards unlocked three things:

Insurance underwriting: Companies can evaluate and insure 3D-printed structures

Regulatory approval: Clear frameworks for permits and structure approval

Capital deployment: Investors and GCs move forward with defined paths

Government adoption proves the point. The $62M Fort Bliss award (10 barracks) only became possible after standards validation. When the Department of Defense contracts for 3D-printed structures, regulators have officially validated the approach.

That confidence cascades to private capital.

What "Additive Construction" Is

Industry moved away from "3D printing" terminology. The term now is "additive construction."

Stephan Mansour, involved in the 2.5-year standards development process published in December 2023, explains the distinction: "Additive construction means building one layer at a time. We created this term for construction specifically because additive manufacturing already exists in aerospace and other industries. We wanted our own framework, our own standards."

Why does this matter? Language shapes perception. "3D printing" evokes novelty. "Additive construction" signals this isn't borrowed technology. Construction has its own standards, safety requirements, and regulatory framework.

When an industry invests in terminology precision, it signals maturation.

How It Works

Additive construction builds layer by layer using robotic systems. Gantries or arms mounted on platforms move vertically as the structure rises. Mixing pump systems deliver material to the robotic applicator. One or two operators manage systems while the crew does other work.

The labor shift is significant. Instead of multiple workers pouring concrete, humans move to higher-value tasks: coordinating placement, inspecting quality, installing other systems. Physical strain decreases. Site safety improves.

Where It's Being Deployed

Additive construction solves different problems for different applications.

Windsor, Canada, has a 3-story, 14,000-square-foot student housing project (net-zero) under construction. Saudi Arabia had a Ministry of Housing pilot in 2018. These address housing shortages where speed and material efficiency matter.

The $62M Fort Bliss contract represents different value. The military valued mobility, use of local materials, and rapid deployment. These benefits matter in military applications, disaster relief, and infrastructure repair.

Specialized applications include coral reefs, sea walls, and custom architectural elements. Specialist contractors avoid expensive molds and casting setups by changing design parameters.

Economic logic shifts by application. Residential economics differ from military to custom components. Some applications become attractive immediately. Others need volume and process refinement. This specificity is healthy.

The Labor Reality

The labor shortage in construction is real. What role does additive construction play?

Additive construction doesn't eliminate the workforce. This is important to clarify. The goal, as Stephan notes, is "to make the construction site more safe and enable the workforce to do more important duties, not deal with menial and tedious tasks on the site."

It requires operators, maintenance, and integration with traditional workflows.

What It Actually Does

It shifts labor from repetitive, menial tasks to higher-value work. Instead of multiple workers pouring concrete, you have operators managing systems and crews handling placement, inspection, coordination.

Physical demands decrease. Site safety improves. Material usage becomes optimized. Design flexibility increases. A contractor creates custom elements and structural variations without new molds.

These aren't revolutionary benefits individually. Combined, they create operational efficiency.

Why This Matters Now

Labor pressure is structural, not cyclical. Geopolitical instability disrupts workforce mobility. Housing demand exceeds skilled labor. Demographic shifts reduce the available workforce. Environmental targets pressure faster, efficient building. Supply chain instability makes local materials valuable.

When you use local materials and build faster with fewer workers, you address multiple pressures simultaneously.

In labor-constrained markets, additive construction becomes attractive because it allows existing workforces to accomplish more. This is labor optimization, not elimination

What Companies Actually Need to Decide

By 2026, additive construction would move from an innovation question to an operational question.

Standards exist. Regulatory paths are defined. The remaining question: Does this solve a specific problem for your business?

Additive construction is viable for specific applications. It's not universally cheaper. It's not the answer for every project. But for particular use cases, economics and operational benefits are compelling.

The Right Questions

Does this solve a particular problem? The answer depends on your project profile. Labor efficiency matters more in tight markets. Custom design matters for bespoke work. Speed matters for time-sensitive projects. Material optimization matters for material-intensive applications.

Regulatory requirements? Increasingly standardized. Capital requirements? Lower than perceived if you partner with operators. Project economics? Case-by-case, not universal.

This moved from "should we be first?" to "does this fit our business model?" If yes, pilot through partnerships. You don't need to buy a printer. If not, monitor for your specific use case.

The Expansion Roadmap

The trajectory from 2026 through 2030 is steady adoption, not explosive scaling.

Government contracts continue with military precedent established. Housing projects publicize results. Insurance frameworks standardize. Multi-story residential buildings become more common.

By 2028-2030, material diversification accelerates. Earth-based materials, recycled waste, non-cement alternatives become viable. Integration into standard workflows deepens. Cost reduction follows volume and optimization. Geographic adoption expands.

Steady adoption is preferable to explosive scaling. It allows the industry to develop operator training, build supply chains, refine safety protocols, and generate economic data.

What Additive Construction Actually Is

Additive construction expands the toolkit. It addresses specific problems in specific applications. Different applications have different economics

Construction will have more options for specific problems. Custom design becomes easier. Some projects move faster. Material waste decreases. Worker safety improves. Sites operate more efficiently in labor-constrained markets.

Additive construction is becoming normal. Practical. Increasingly boring. That's progress.

The Five Realities You Need to Understand

1. Standards are now the competitive moat.

Standards exist. Insurance frameworks are developing. Government contracts are being awarded. The infrastructure supporting adoption is in place, and firms operating within validated frameworks move forward while those waiting for perfect conditions fall behind.

2. Assurance drives adoption, not innovation.

Construction rejects unproven methods; it doesn't matter if they are old or new. Your advantage comes from identifying what assurance looks like in your specific market and application. Fort Bliss succeeded because it aligned with military procurement requirements. Your project succeeds because it aligns with your market's constraints: labor availability, regulatory environment, cost structure, and timeline.

3. Design flexibility and material optimization create economic value.

Additive construction offers design flexibility traditional methods can't match. Material usage becomes optimized. Labor shifts from repetitive tasks to higher-value work. These create compound operational advantages in labor-constrained markets. The technology enhances safety and efficiency on job sites. Identify where these benefits compound in your business.

4. Capital flows to clear execution signals.

Investors and insurance companies fund execution, not innovation. The firms that are winning capital in the next 18 months demonstrate clear application-market-economics alignment. They're tracking their specific market for when regulatory approval and cost economics align simultaneously.

5. View it as a tool within your existing practice, not a replacement.

3D printing optimizes specific project types in specific markets, not your entire operation. Geographic variation determines timing, with labor-constrained regions and housing demand moving first. Track regulatory approval status in your key markets as your signal for when civilian adoption accelerates in your region.

The validation framework is in place. What happens next depends on whether you've identified where it creates value in your business.

Check out the episode with Stephan Mansour here 👇👇👇

Which application excites you most: faster housing solutions, reduced labor dependency, or material cost optimization? Reply and let me know—we’re collecting feedback for a future piece on implementation roadmaps.

WEEKLY MUSINGS

Viral Hardware, Needle Movers, AI Agents

The bootstrapper’s playbook

Low stakes, high leverage

The rise of the “agentic" admin

YOU MIGHT ALSO LIKE

Our Top Insights

Most Popular Episodes

Reports & Whitepapers

OUR SPONSORS

Aphex - The multiplayer planning platform where construction teams plan together, stay aligned, and deliver projects faster.

Archdesk - The #1 construction management software for growing companies. Manage your projects from Tender to Handover.

BuildVision - Streamlining the construction supply chain with a unified platform for contractors, manufacturers, and stakeholders.