Want to get your message in front of {{active_subscriber_count}} highly engaged innovation leaders? Check out our sponsorship offers.

NEW RELEASE

Special Bonus for Subscribers: The GTM Bundle

Construction is not just another vertical. It’s regional, relationship-driven, and project-based. That means what works in traditional B2B SaaS (spray-and-pray marketing, automated funnels, cookie-cutter pricing) falls flat when selling to contractors, owners, and GCs.

That’s why we created two deep-dive playbooks, built with and from the people who have actually scaled in this industry.

And now, we’re bundling them together.

🎁 The GTM Bundle

Individually, each guide is $100.

Today, you can get both for $150.

Together, they give you the full GTM playbook for construction tech from building trust-first marketing to structuring your sales motion, pricing models, and land-and-expand strategy.

INDUSTRY INSIGHTS

From Fulfillment to Foundations: What Construction Can Learn from Amazon Robotics

Breaking the Assembly Line Myth in Construction

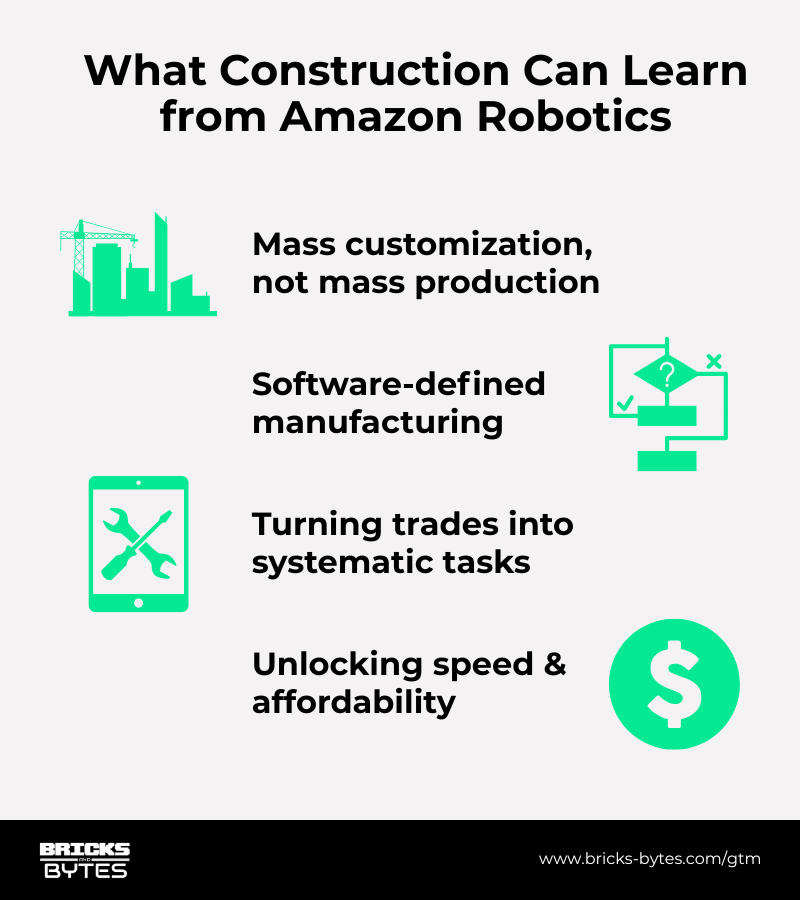

Construction's unique challenge: unlike manufacturing, no two sites are the same. Varying codes, soil conditions, and client demands make mass production tactics ineffective. It's not a labor shortage issue. It's a mass customization problem.

One company applying Amazon's fulfillment principles is building 30 times more square footage this year. Led by Amazon Robotics veteran Vikas Enti, they're recognizing that construction tech has been solving the wrong problem entirely.

Why does this matter beyond efficiency? The built environment generates 40% of carbon emissions. The recipes for climate-resilient homes exist, but traditional construction economics make them unaffordable. Solving mass customization could unlock both speed and sustainability.

Vikas Enti. Credit: Reframe Systems

TL;DR: From Fulfillment to Foundations

Construction doesn’t have a labor shortage problem. It has a mass customization problem. Unlike manufacturing, every site is different, breaking the assembly-line model most contech startups chase.

An Amazon Robotics veteran is applying fulfillment principles to construction, enabling “pixels to parts” in under nine minutes and employing 60% apprentices with software-driven instructions.

The big unlock? Treating construction as an information architecture challenge, not just a supply chain one.

Why it matters:

Faster builds (30x more sq. ft. this year).

Lower costs ($275/sq. ft. vs. $350–450).

Climate potential: solving mass customization could make sustainable housing affordable.

Takeaway: The future of construction won’t be won by bigger factories, but by smarter information systems.

Why Every Assembly Line Assumption Is Wrong

Walk into any construction tech boardroom. You'll hear the same strategy:

Solve the labor shortage through industrialization.

Mass production. Assembly lines. Standard modules replicated across sites.

The logic seems bulletproof. Manufacturing transformed every other industry by moving from craft production to standardized processes. Construction should follow the same playbook.

Except construction has a fundamental difference that breaks every mass production assumption.

Every site is unique. Building codes vary by municipality. Zoning requirements change home dimensions.

The intersection of site conditions, local regulations, and zoning codes means you almost never replicate the exact same product across locations.

"This is not a mass production problem," explains the former Amazon executive.

"This is a mass customization problem."

Mass customization breaks assembly lines. You can't optimize for one standard output when every output must be different.

Instead, you need what his team developed at Amazon: software-defined manufacturing that treats variety as a feature, not a bug.

The insight transforms everything.

Instead of fighting customization, you build systems that make customization manageable.

From Pixels to Parts in Under Nine Minutes

The breakthrough concept is "pixels to parts": seamless flow from design changes to manufacturing instructions.

Here's how it works in practice:

Someone on the factory floor finds an assembly issue. They flag it on an iPad. The problem flows back to engineers who identify the mistake, update the CAD model, and push changes back to production.

Fastest recorded time: under nine minutes.

Compare that to traditional construction, where the same change takes weeks of coordination between architects, engineers, and contractors, plus change order fees.

The speed comes from treating construction as an information problem, not just a supply chain challenge.

Traditional construction relies on implicit knowledge.

A plumber looks at a line drawing and knows from years of experience how to convert that line into fixtures, routing, and attachments. That expertise lives in their head.

Software-defined manufacturing makes implicit knowledge explicit.

Instead of showing trades a simple line marked "cold water pipe," the system generates complete instructions: every clip needed to route the pipe, every hole to drill, bending radius requirements, and exact lengths.

The information transformation enables something significant:

Turning skilled trades into systematic tasks.

Workers receive iPad instructions that resemble assembly manuals. Parts are pre-labeled and pre-cut. Components are designed to fit together in specific orientations. Holes are pre-drilled in exact locations.

Their factory now employs 60% apprentices: workers new to trades who can perform framing, plumbing, and electrical work through better information architecture rather than years of experience.

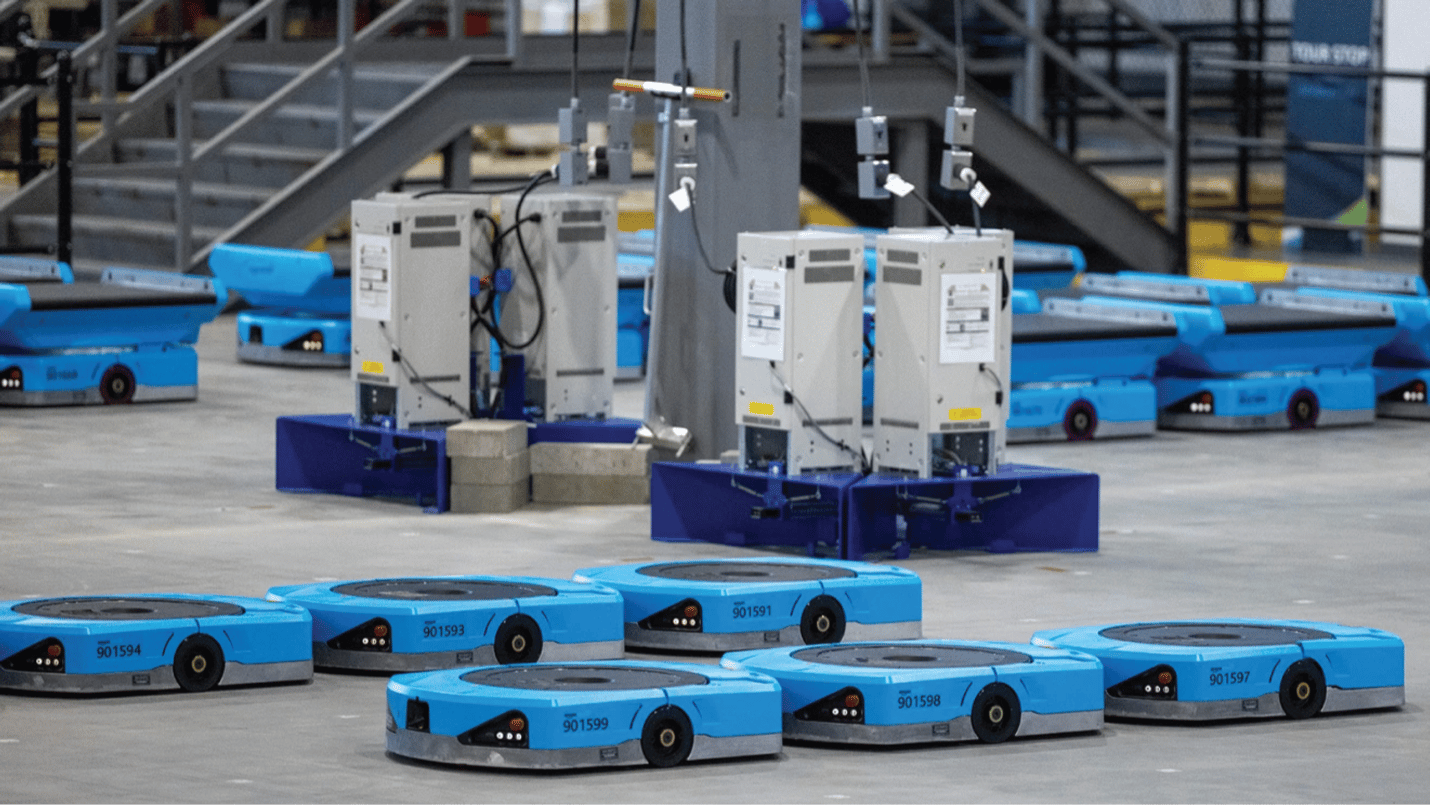

Reframe’s microfactories use software‑defined robotics to transform design into buildable components. Credit: Reframe Systems

The Change Management Reality

Even Amazon veterans underestimated how differently construction operates.

The first surprise: Finding professionals who could work at software speed.

Their original architect ended the relationship, citing too-frequent design changes and unrealistic timelines. The industry trains people to think in months and years, not hours and days.

The solution required bringing architectural and engineering talent in-house: a costly decision that many construction tech companies avoid.

The second surprise: Industry resistance to new business models.

Initially, they planned to sell technology to existing manufacturers. Factory owners weren't interested. One memorable response: "Chuck's been doing this for 13 years. Chuck's not broken. Why should I change it?"

Next, they tried selling components to general contractors. GCs worried about losing control and didn't want volumetric modules changing their workflows.

The breakthrough came from targeting developers instead.

Developers care about IRR and speed to market, not construction methodology.

But here's the strategic insight: instead of fighting industry structure, they abstracted their innovation behind familiar contracts. They operate as a design-build general contractor using standard AIA agreements.

The lesson extends beyond construction:

Sometimes changing an industry means first conforming to its existing frameworks while building new capabilities underneath.

Market Strategy That Actually Works

The economic validation is clear:

They price at $275 per square foot in markets where traditional construction costs $350-450 per square foot.

But notice their market choice. They didn't target production homebuilders who already build efficiently at $100-120 per square foot. Those builders achieve low costs through scale and repetition.

Instead, they focused on infill construction: adding density in existing neighborhoods where traditional methods struggle with efficiency.

In these markets, their approach delivers immediate value without competing on established players' strengths.

The factory economics support distributed manufacturing: 50,000 square feet producing 250-500 homes annually with an estimated 40-80 workers.

Small enough to locate near demand. Large enough to capture manufacturing efficiencies.

This creates a tension that every construction tech company faces:

Capture cost savings as profit margins or pass savings through to improve affordability?

The answer may determine whether innovation serves existing real estate economics or transforms them.

The Information Architecture Advantage

Most attempts at construction automation focus on supply chain problems: different materials, controlled manufacturing, vertical integration.

But the real constraint is information architecture.

How do you convert implicit trade knowledge into explicit, repeatable instructions? How do you make design changes flow to manufacturing without breaking downstream processes?

Software-defined manufacturing reorganizes information flow to eliminate the human interpretation layers that create delays, errors, and cost overruns.

That reorganization creates advantages that compound over time.

Every project generates data that improves subsequent projects. Every design iteration strengthens the software. Every process improvement scales across operations.

The construction industry is discovering what Amazon learned in fulfillment: when you solve information problems systematically, physical operations become remarkably efficient.

Focus on information architecture first, automation second.

The companies that master data flow will define the industry's trajectory.

Watch the episode with Vikas Enti here👇👇👇

Recommended Reading

Software Defined Manufacturing | Deloitte: A deep dive into how software-driven production boosts industry agility and efficiency.

How Amazon Robotics Changed Fulfillment | Exotec: Insights on robotic and software integration transforming scalable logistics.

Intrigued with the fascinating developments redefining the construction tech landscape? Subscribe to our newsletter to explore the growing archive of insights from industry pioneers.

WEEKLY MUSINGS

Robotics Powerhouse, Sustainable Construction, Roll-up Strategies

FieldAI emerges from stealth

Mass timber is getting a major boost

From skepticism to sudden interest

YOU MIGHT ALSO LIKE

Premium Insights

More Insights

Reports and Case Studies

Most Popular Episodes

Super Series

OUR SPONSORS

BuildVision — streamlining the construction supply chain with a unified platform for contractors, manufacturers, and stakeholders.