INDUSTRY INSIGHTS

From Zero to Trimble Materials: How StructShare Built an 8-Year Procurement Platform Worth Acquiring

How Or Lakritz turned early missteps into strategic advantages, partnered with Procore, and closed a 10-month deal that made his 21-person team the cornerstone of Trimble's materials strategy

Building a construction tech company that gets acquired isn't about luck. It's about making strategic decisions at critical moments, even when those moments don't feel strategic at the time.

Or Lakritz and his team at StructShare spent eight years building a procurement platform for specialty contractors, navigating everything from product-market fit questions to investor relationships to integration strategies with major platforms. The result: Trimble acquired the company and relaunched it as Trimble Materials in under a month.

This is the story of the five pivotal decisions that transformed a 21-person startup into a strategic asset, and what founders can learn from each one.

TL;DR:

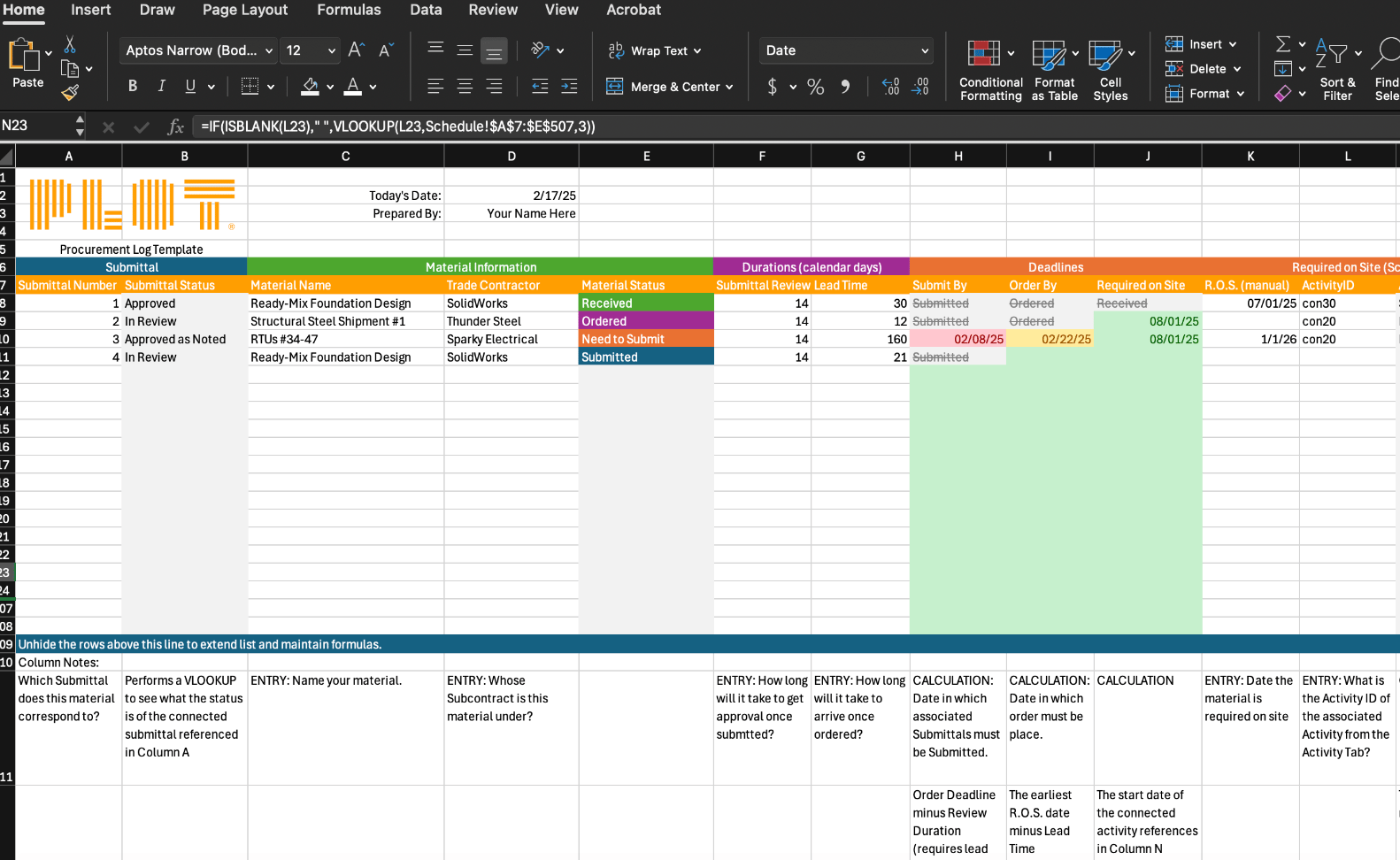

Find the real gap. Or Lakritz built StructShare for specialty contractors stuck on spreadsheets (slow market, real pain, little competition).

Measure what matters. Despite strong sales, weak daily usage triggered a hard reset toward adoption, retention, and workflow stickiness.

Partner for leverage. Early integration with Procore delivered credibility and distribution no sales team could match.

Trust saves companies. When a 2024 round fell apart, strong investor relationships kept the business alive.

Prepare the team. Transparent communication made acquisition a continuation, not a shock.

Right buyer, right time. Trimble needed procurement now, not later, making StructShare a clear buy.

Result: After 8 years and a 10-month deal, StructShare became Trimble Materials; proof that patient category-building + real usage beats hype every time.

Identifying the Opportunity

When StructShare launched eight years ago, Or Lakritz saw something others had missed: specialty contractors were running procurement on spreadsheets, emails, and text messages while general contractors had sophisticated tools. The gap was obvious, but the opportunity required patience.

Without existing digital solutions to reference, every customer conversation meant explaining not just why StructShare was better, but why digitization itself mattered. This market education phase proved challenging, but it also meant building in a space with real demand and minimal competition. The company was creating a category, not just competing in one.

This is consistent with broader industry patterns. A McKinsey study suggests that even today, large contractors spend less than 1 percent of revenues on IT, and technology uptake remains slow and heavily skewed towards basic control rather than workflow transformation.

That foundation would prove valuable years later when strategic acquirers started looking for proven solutions in the procurement space. There were legacy players and a few attempts that had already shut down, but no one was truly serving specialty contractors with modern digital tools.

The Pivot That Changed Everything

Learning to Measure What Matters

In 2023, StructShare's sales team was closing 40 to 50 percent of their demos. For most founders, this signals strong product-market fit and justifies scaling sales operations. Or and his co-founder Eric made that investment, confident in their momentum.

What they discovered changed how they thought about success. While sales numbers looked strong, usage patterns told a different story. Customers were buying StructShare but not embedding it deeply into their daily workflows. The insight led to what Or calls a "hard reset," but it was really a strategic refocus.

Rather than continuing to pour resources into top-of-funnel growth, they shifted their entire organization toward understanding customer behavior. The new priority became learning why some customers adopted the product fully while others didn't, then using those insights to refine the product.

This decision required conviction. Pausing growth initiatives when sales are strong goes against startup instincts. But the refocus paid off. By prioritizing usage and retention over new customer acquisition, StructShare built a product that customers actually depended on. That stickiness became a key asset when acquisition conversations began.

The reset worked. They refocused both on costs and team priorities, shifting from measuring success by sales volume to measuring it by customer learning. Or reflects on the strategic shift: "In the early days, you need to measure your success in the amount of learnings you are doing in order to build the right product."

Early-stage success metrics should emphasize customer behavior and product integration, not just revenue growth. The companies that get acquired at attractive multiples are the ones solving real problems that customers can't easily replace.

Strategic Integration as Growth Lever

The Procore Partnership Strategy

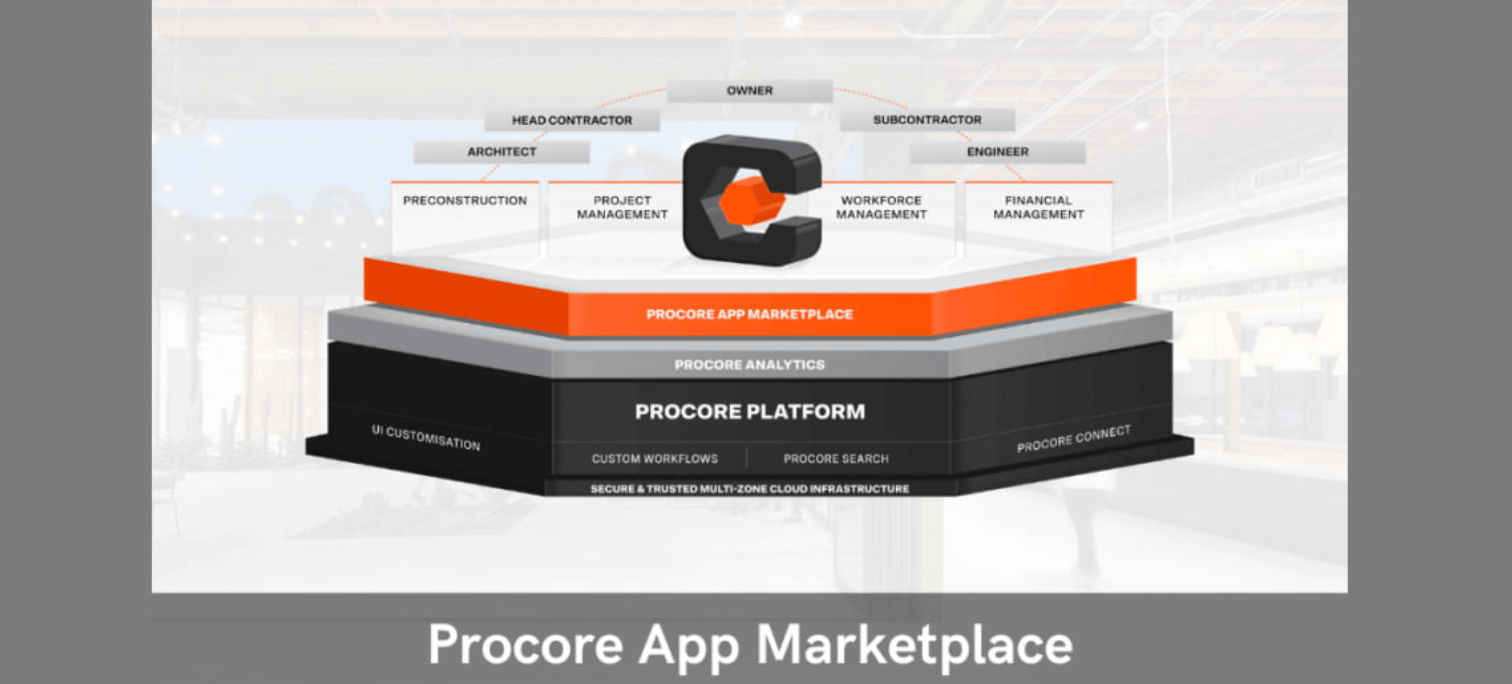

In May 2021, StructShare became the first procurement application in the Procore Marketplace. The decision reflected a clear-eyed view of their market position and growth challenges.

Or's logic was straightforward: StructShare needed distribution, and Procore had the largest customer base in their target market. More importantly, Procore was investing in serving specialty contractors but lacked a materials management solution. The partnership created mutual value.

Some founders worry that integrating with larger platforms reveals too much about their approach or creates risk of being copied. Or saw it differently. The real risk was remaining invisible in a market where customers already trusted and used Procore daily.

"If I won't be integrated or won't work with them, what's the risk? They will know what I'm doing if they will care about my space, any case."

Integration gave StructShare immediate credibility and access to thousands of potential customers who were already comfortable with digital tools. The relationship went beyond a simple API connection. StructShare built strong working relationships with Procore's specialty contractor team, positioning themselves as the solution for a specific, critical function.

When acquisition discussions began years later, StructShare had already established itself as a proven player in the ecosystem. Or notes that their initial go-to-market strategy was significantly leveraged by their close partnership with Procore.

Looking ahead, Or sees the platform partnership dynamic evolving with AI and LLMs. The larger platforms have the customer base and distribution assets that remain difficult for startups to replicate, even as technology changes the landscape.

In construction tech, strategic partnerships with established platforms can accelerate growth and credibility in ways that pure sales efforts cannot. The key is identifying where your capabilities complement rather than compete with the platform's priorities.

Building Investor Relationships That Last

Why Trust Matters in Down Markets

By early 2024, StructShare had assembled what looked like an ideal funding round: a committed lead investor and several strategic partners ready to join. Then market conditions shifted, and four strategic investors withdrew their commitments.

What could have been a company-ending crisis became a manageable challenge because of one factor: the relationship Or and Eric had built with their lead investor, Compass VC. Rather than walking away when the round fell apart, Compass bridged the company for six months, giving them time to navigate the situation and ultimately close the round successfully.

This outcome wasn't luck. It reflected years of transparent communication, consistent execution, and demonstrated ability to navigate challenges. When market conditions make spreadsheet logic difficult, investors back founders they trust to find solutions.

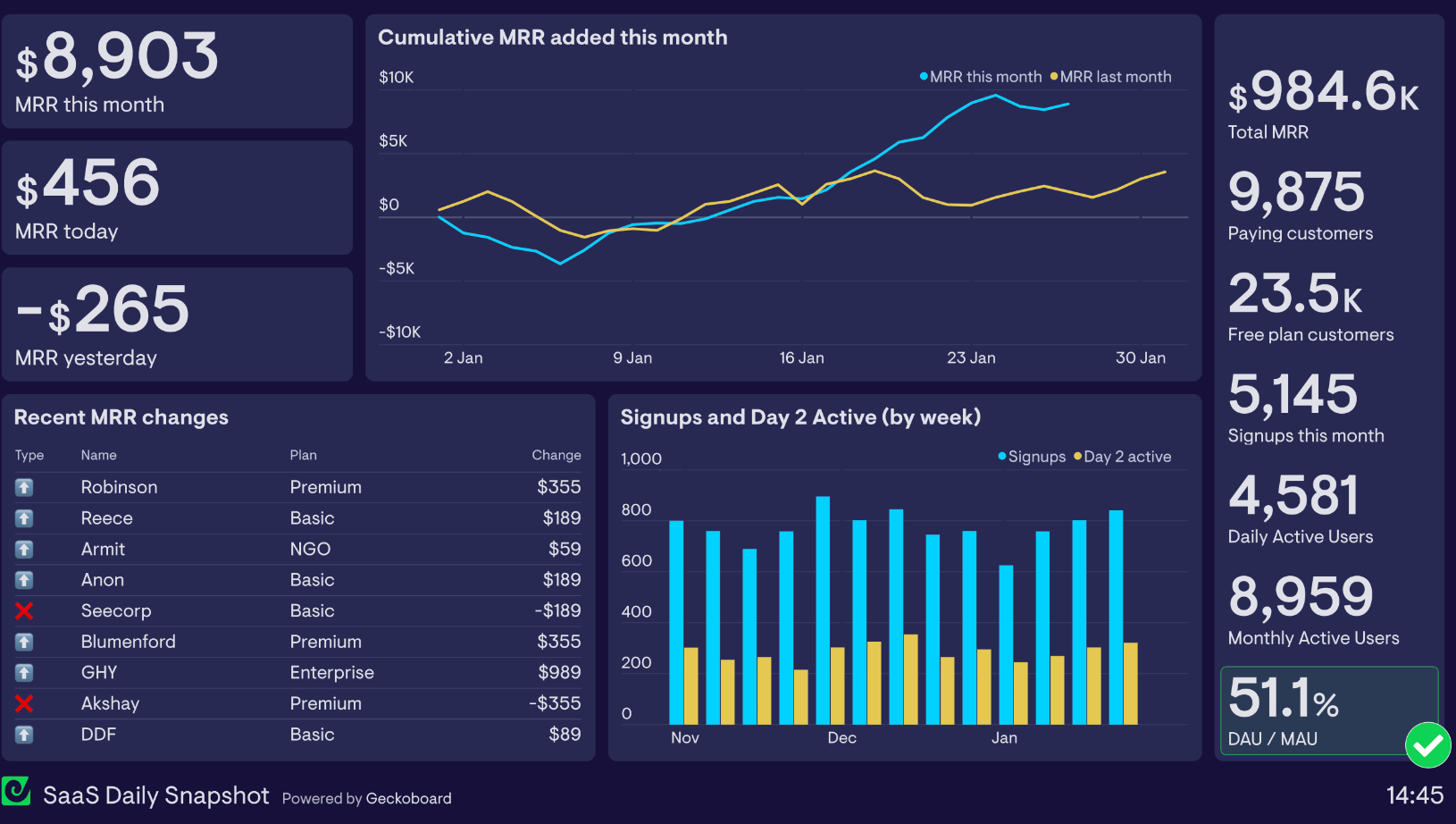

The experience also reinforced the importance of fundraising strategy in construction tech. This industry requires more proof than typical SaaS markets before investors commit. Sales cycles are longer, adoption takes time, and demonstrated traction matters more than projected growth.

"The main thing I would say first of all is that they will trust you. They will trust that even if you are doing mistakes, they are trusting you that you are trying the best and that you are smart enough to navigate."

Successful founders plan their funding milestones around these realities from the beginning, ensuring they're raising when they can show the evidence investors need to feel confident. Or's advice for early-stage founders centers on this point: build the milestones, understand when you're going to fundraise when you know you have the momentum. The mistake many founders make is fundraising urgently, which leads to accepting whatever terms are available and focusing on short-term results rather than long-term planning.

The right investors become partners who support you through difficult periods, not just during growth phases.

Preparing the Team for Scale

Transparency as Integration Strategy

When acquisition conversations became serious, Or made a deliberate choice about communication. Rather than keeping potential exits quiet until deals were certain, he shared with his 21-person team that acquisition was a possible direction and explained the strategic reasoning behind it.

The approach paid off during integration. When StructShare officially became part of Trimble, the team experienced it as a continuation of their mission rather than an unexpected change. They understood the logic and felt included in the decision-making process.

This transparency reflected broader principles about team building that served the company well throughout its journey. In small teams, every hire significantly impacts culture and execution. Or emphasizes hiring deliberately for the specific stage the company is in, and moving decisively when someone isn't the right fit.

The integration with Trimble went smoothly in part because of this foundation. While joining a large organization presented challenges, particularly around maintaining the close-knit culture and direct customer relationships that defined StructShare, the cultural alignment between the two companies made the transition manageable.

The quality of the team determines both what you can build and how attractive you are to potential acquirers. Strong teams with a clear understanding of company direction integrate more smoothly and maintain momentum through transitions.

Finding the Right Acquirer

Why Trimble Made Sense

The acquisition emerged from strategic alignment, not desperation. Or had maintained relationships with potential acquirers throughout StructShare's journey, understanding what each might value about the company.

Trimble had substantial assets in supply chain data and supplier networks, but needed a solution that contractors would actually adopt for procurement. Their existing tools served other functions well, but the procurement persona wasn't using them. Meanwhile, competitors were moving quickly in the space.

For Trimble, this was a classic build versus buy decision. Building a procurement solution from scratch would require years. They needed a team already in the market with proven expertise in specialty contractor workflows and a product customers trusted. The timing proved critical.

The timeline from serious conversations to close took roughly 10 months, with five months dedicated to due diligence. As a public company, Trimble conducted thorough examination of everything from code security to financial records to partnership agreements. Or describes the process as more intensive than he'd anticipated for a company of their size, but it validated the strength of what StructShare had built.

The outcome demonstrated the strategic value both sides saw in the deal. Less than a month after acquisition, Trimble relaunched the product as Trimble Materials. Trimble's own launch notes describe it as an end-to-end purchasing, inventory, and accounts payable solution designed to give contractors tighter control over material costs and inventory visibility, which is exactly the operational gap StructShare had spent eight years attacking.

The speed of that rebrand showed how central the acquisition was to their strategy. StructShare wasn't being absorbed into a larger product suite; it was becoming a cornerstone of Trimble's approach to serving contractors.

"We were acquired and after less than a month, we already launched the new product, Trimble Materials. Trimble allows us to do what we think is the future as well. We are building the foundation for how procurement will look."

Or continues to lead product vision at Trimble, now building what he calls an "AI-first procurement platform" while maintaining the core capabilities that made StructShare valuable. He operates with significant autonomy, describing the internal process of securing resources as similar to fundraising: you still need to articulate a vision and demonstrate ROI.

The integration has allowed StructShare's vision to continue, now with the resources and platform of a much larger organization. Eric, Or's co-founder, leads the foundational work on how procurement will look in the coming years, building in parallel with enhancing the current workflow-based platform.

For founders considering potential exits, the most successful acquisitions happen when you've solved a specific problem that the acquirer views as strategically important. Your product becomes an asset they need immediately, not just an interesting technology they might explore.

What Makes Strategic Acquisitions Work

StructShare's integration with Trimble succeeded because both sides understood exactly what they were building together. Trimble needed specific capabilities they couldn't quickly replicate. StructShare had built precisely that: a focused solution for a defined market, backed by a team that could integrate efficiently.

The cultural alignment mattered as well. Both organizations valued similar approaches to building products and serving customers, which made the transition smoother for everyone involved. Or identifies several factors Trimble considered important beyond just the product itself: synergy with the founders and team, both personally and in vision, proved critical. The size of the team also played a role. At 21 employees, StructShare could integrate without creating organizational chaos or requiring extensive restructuring.

Looking back at the eight-year journey, Or sees the path clearly. His advice centers on three core areas: hiring diligently and thinking carefully about who you bring to the team at each specific stage; avoiding fundraising urgency that leads to poor decisions and short-term thinking; and understanding your product market fit very well, being diligent about measuring what truly matters rather than being distracted by vanity metrics.

For the construction tech industry specifically, Or sees procurement as increasingly important because it sits at the center of the entire ecosystem, connecting estimating, project management, financial management, field operations, office functions, and vendor relationships. That centrality made StructShare attractive to multiple types of potential acquirers, from large platforms like Trimble and Procore to private equity firms looking to build construction tech portfolios.

The question isn't whether you can sell your company. The question is whether you're building something valuable enough that an acquirer would rather buy your solution today than spend years building their own version.

Watch the episode with Or Lakritz here 👇👇👇

StructShare's journey from serving a market gap to becoming Trimble Materials took eight years of focused execution, strategic partnerships, and disciplined decision-making. The construction tech landscape continues evolving, particularly with AI creating new possibilities in procurement and materials management. Or's team is now building the foundations for what they call an "AI-first procurement platform," working on how procurement will function in the next one to three years.

Or's experience offers a roadmap: build for real usage, partner strategically, cultivate investor relationships, maintain team transparency, and stay focused on solving problems that matter enough to be strategic assets.

What's working in your construction tech go-to-market strategy right now? Reply and share what you're learning.

WEEKLY MUSINGS

Series A, Legacy, Tax Flight

More than just a funding round

Lessons that guide every day

The 2026 "Billionaire Tax" trigger

YOU MIGHT ALSO LIKE

Premium Insights

More Insights

Reports and Case Studies

Most Popular Episodes

Super Series

OUR SPONSORS

Aphex - The multiplayer planning platform where construction teams plan together, stay aligned, and deliver projects faster.

Archdesk - The #1 construction management software for growing companies. Manage your projects from Tender to Handover.

BuildVision - Streamlining the construction supply chain with a unified platform for contractors, manufacturers, and stakeholders.