Want to get your message in front of {{active_subscriber_count}} highly engaged innovation leaders? Check out our sponsorship offers.

INDUSTRY INSIGHTS

The 80/20 Rule for Product Expansion: When to Build Your Second Product (& When NOT to)

How a leading reality capture company learned that resource discipline beats diversification in product expansion

When is the right time to build your next product? It's one of the hardest decisions AEC tech founders face, and the stakes couldn't be higher.

The temptation is strongest when customers start asking. When big-name contractors say, "Build this; we'll pay lots of money." When adjacent markets seem ripe for expansion. When the core product is gaining traction and confidence is high.

That's precisely when Matt Daly's team at DroneDeploy built SmartTrack, a production tracking tool for drywall and framing contractors. It had eager customers, clear market demand, and a team that knew how to execute.

Despite having many advantages, SmartTrack ultimately failed.

The story reveals one of the most counterintuitive truths about product expansion: resource discipline, not resource abundance, drives sustainable growth. The framework that emerged from this failure should guide every founder's expansion decisions.

Matt Daly is the Chief Marketing Officer at DroneDeploy and ex Co-founder-CEO at StructionSite

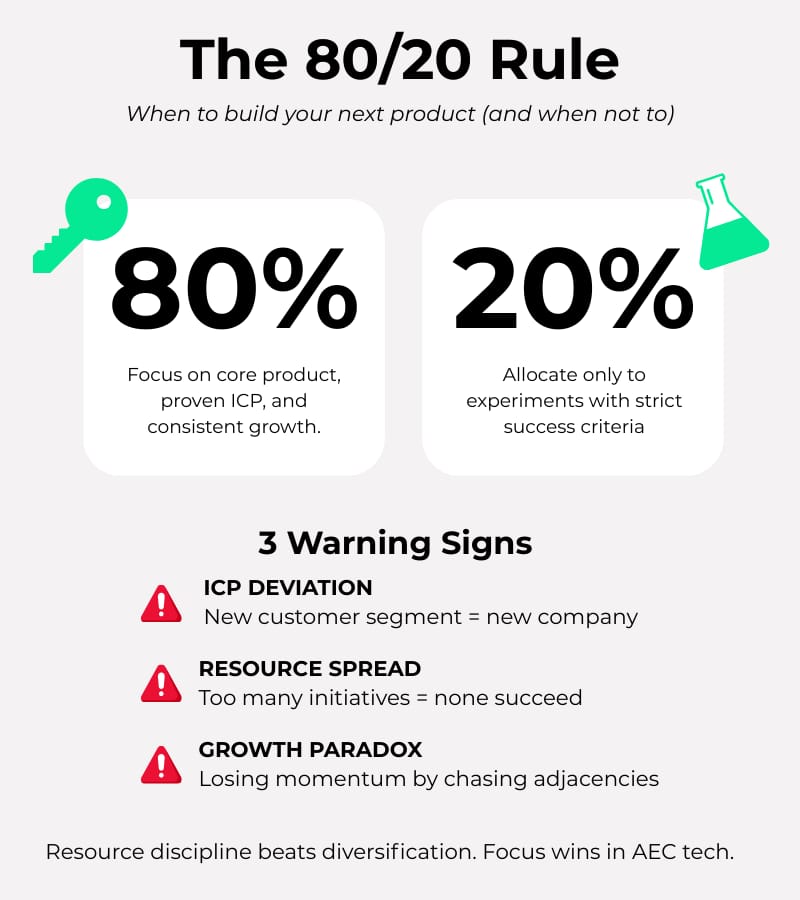

TL;DR: The 80/20 Rule for Product Expansion

DroneDeploy’s failed SmartTrack product shows why timing and discipline matter more than customer demand when expanding beyond your core product. The biggest mistake? Diverting focus from your Ideal Customer Profile.

The 80/20 rule is the antidote:

Keep 80% of resources focused on your core product.

Use 20% for tightly scoped experiments with strict success criteria (repeatable sales, customer re-buying).

🚩 Red flags for expansion:

Moving away from your ICP.

Spreading resources too thin.

Slowing core growth just as momentum builds.

In AEC tech, trust and focus beat diversification. Say no more often than yes because the companies that win are the ones that go deeper, not broader.

The Fatal Flaw That Kills Product Expansions

The problem wasn't the technology or market demand. SmartTrack worked, customers used it, and the need was real.

The fatal flaw was simpler: it took the company away from their core customer base.

DroneDeploy had built their business serving large general contractors. These customers knew them, trusted them, and consistently bought from them. SmartTrack targeted trade contractors who operated in entirely different workflows, had different decision-makers, and had never heard of the company.

"It's like starting a new company when you decide to move into a different segment," Daly reflects. "You pick up the phone to call these customers, and they have no idea who you are."

The result?

A low-margin, expensive, slow product that required constant human intervention despite promises of automation. Every sale felt like a journey upstream. Growth didn't accelerate; it stalled.

This phenomenon is the classic expansion trap: mistaking customer requests for market validation and confusing product-market fit in one segment with the ability to succeed in another.

The 80/20 Framework for Product Expansion

From this failure emerged a resource allocation philosophy that should guide every expansion decision:

Cap new experiments at 10-20% of your R&D resources. Period.

This isn't a suggestion. It's a hard limit. The remaining 80% stays focused on the core business that's driving growth.

Why such rigid discipline? Because in early-stage companies, growth is everything. You've got to grow, or you fade away, and you don't want that growth to slow down.

Test smart: Use 20% of resources to validate new ideas with discipline and clarity. Credit: Dreamstime

But the 20% isn't just about limiting downside risk. It's about creating space for systematic experimentation with clear success criteria:

The Repeatability Test: Can a non-founder sales rep successfully sell this product? If founders have to sell every deal, it's not scalable.

The Customer Behavior Test: Do customers buy a small amount initially, then come back for more? This signals genuine product-market fit, not just polite pilot purchases.

When experiments meet both criteria consistently, they can gradually migrate from the 20% bucket into core operations. Start with two reps this quarter; add two more next quarter. Let success drive resource allocation, not enthusiasm.

When NOT to Build Your Second Product

The construction industry has plenty of solid products that have stunted growth momentum. According to research from Business Talent Group, many market adjacency moves in established sectors tend to fail. This scenario often happens when companies underestimate local competition, overestimate customer demand, or jump into adjacent markets too soon.

Three warning signs that expansion will backfire:

The ICP Deviation Trap: Any product that takes you away from your proven Ideal Customer Profile requires treating it like a completely new business. You're not leveraging existing relationships; you're building them from scratch while your core business waits for attention.

The Resource Reality Check: Most companies can only successfully bring one or two new products to market at a time. Spreading focus across multiple initiatives typically means none receive adequate resources to succeed.

The Growth Paradox: Early-stage companies face immense pressure to show consistent growth. Diverting resources to unproven products just when momentum is building creates dangerous vulnerability.

The temptation is strongest when customers from adjacent markets start asking for solutions. But customer requests aren't always market validation; they're often one-off needs that don't scale.

Timing Product Expansion Right

So when is the right time to expand? The answer isn't about market conditions or competitive pressure. It's about internal metrics and organizational readiness. The underlying principles for expansion, followed by top-notch tech giants, could add a fresh perspective.

Progressive Resource Migration: Successful experiments don't suddenly become core products. They earn their way there by consistently hitting targets while consuming minimal resources. Two sales reps become four, four become eight, but only when each expansion proves sustainable.

Natural Integration Signals: The best second products feel inevitable to customers and teams alike. They solve problems that naturally arise from using the core product, creating complementary value rather than competing for attention.

Capacity Beyond Core: True expansion readiness means having proven systems for hiring, training, and scaling operations. If adding new products strains basic execution, the timing is wrong regardless of market opportunity.

The Construction Tech Difference

AEC presents particular difficulties with product expansion. Projects last years, not months. Buying decisions involve multiple stakeholders with different priorities. Building trust takes a lifetime, but it can be destroyed in a matter of seconds.

These realities make the 80/20 rule even more critical. Construction customers value consistency and reliability over innovation for its own sake. They want partners who excel at specific solutions, not vendors who might disappear next quarter.

The most successful construction tech companies build platforms that serve multiple use cases within their core strength. Each capability reinforces the others rather than pulling in different directions.

The Discipline Advantage

Resource discipline goes beyond merely preventing failures. It focuses on achieving success through methods that are difficult for competitors to emulate.

When 80% of resources stay focused on core strengths, improvement accelerates. Products get better faster, customer satisfaction increases, and word-of-mouth referrals multiply. Sustained excellence in a core domain creates the kind of customer loyalty that becomes nearly impossible for competitors to disrupt.

Meanwhile, the 20% allocation creates systematic learning without existential risk. Experiments either graduate to core offerings or fail fast with minimal damage. This approach scales: successful companies can run multiple 20% experiments simultaneously without losing focus on what built their success.

The Counterintuitive Truth

The construction industry rewards depth over breadth, especially in technology adoption. Contractors would rather not manage relationships with dozens of point solutions. They want comprehensive platforms from trusted partners.

This creates a powerful dynamic: companies that resist the urge to chase every adjacent opportunity can build more profound customer relationships that become nearly impossible for competitors to disrupt.

The lesson for AEC tech CEOs is clear but challenging to execute: saying no to good opportunities is often the key to building great companies. Resource discipline beats resource abundance. Focus beats diversification. Success depends on trust and relationships. The companies that stay true to their discipline are the ones building platforms that genuinely matter.

Watch the episode with Matt Daly here👇👇👇

NEW RELEASE

Special Bonus for Subscribers: The GTM Bundle

🎁 The GTM Bundle

Individually, each guide is $100.

Today, you can get both for $150.

Together, they give you the full GTM playbook for construction tech from building trust-first marketing to structuring your sales motion, pricing models, and land-and-expand strategy.

WEEKLY MUSINGS

Marketing, AI Image Generation, Billion-dollar Losses

Can't automate a good marketing strategy

As humorously demonstrated by this celebrity mash-up

Can an AI company hide losses with accounting?

YOU MIGHT ALSO LIKE

Premium Insights

More Insights

Reports and Case Studies

Most Popular Episodes

Super Series

OUR SPONSORS

Archdesk - The #1 construction management software for growing companies. Manage your projects from Tender to Handover.

BuildVision - Streamlining the construction supply chain with a unified platform for contractors, manufacturers, and stakeholders.