Want to go deeper? Join our Patreon community for exclusive, not publicly available content and support the future of architecture, engineering, and construction.

INDUSTRY INSIGHTS

The Story Behind $1.5bn Unicorn Built Technologies

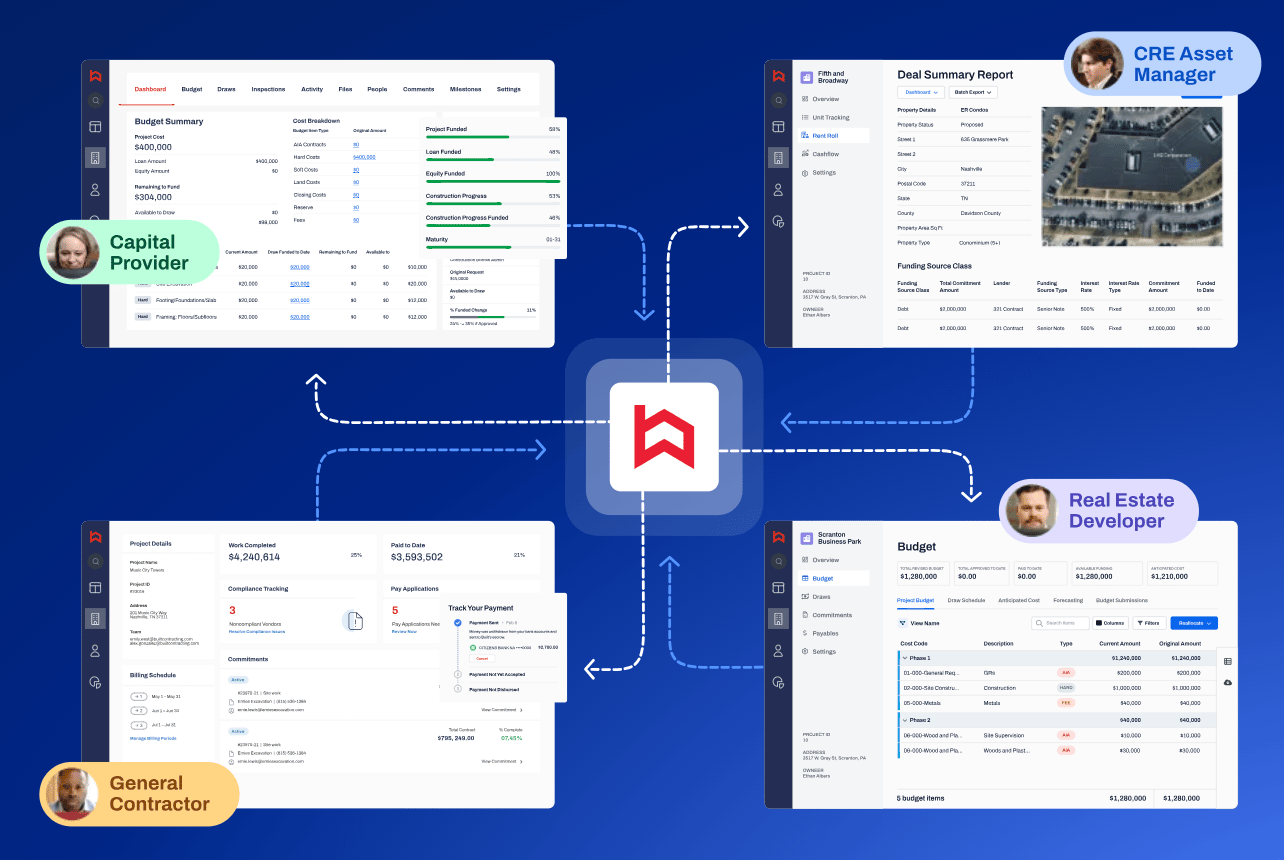

When Chase Gilbert and his co-founders started Built Technologies in 2014, they took an unconventional approach to construction technology. Instead of targeting contractors or project managers, they followed the money upstream to the source: banks and lenders.

The strategy paid off. Built Technologies reached unicorn status in 2021 with a $1.5 billion valuation. Their platform now manages over $200 billion in annual construction spend across 300+ financial institutions. But what makes their story particularly interesting isn't just the numbers – it's the insights their journey offers for anyone working in construction technology.

Chase Gilbert, CEO of Built Technologies

Starting Upstream Changes Everything

Construction relies on efficient capital flow, yet the industry's financial processes have remained stubbornly antiquated. Built Technologies recognized that by starting with lenders, they could create a powerful ripple effect throughout the entire construction ecosystem.

The math is compelling: one bank relationship can unlock hundreds of downstream connections with contractors and developers. When Built signs a new bank, they gain access to every construction project that bank finances. This creates a natural distribution channel that would be nearly impossible to build by approaching contractors individually.

Measurable Impact Drives Adoption

Before Built Technologies entered the market, construction loan processing was a mess.

Banks typically took five or more business days to process draw requests. Many institutions needed eleven back-office staff just to manage their construction loan portfolio. The process was manual, paper-based, and prone to errors.

Built's platform changed this dramatically.

Draw requests now process same-day. Banks have reduced their staff requirements by 80%. Real-time project tracking and risk monitoring have replaced manual spreadsheets. These aren't just incremental improvements – they're transformational changes that create measurable value.

The Power of Value-Based Pricing

Chase shared a revealing anecdote about their early pricing strategy. One of their first bank clients paid $50,000 annually for the platform. Built later discovered they were creating $2.5 million in value for that client. This massive value gap didn't lead them to immediately raise prices. Instead, they used it to build trust and expand their footprint.

The lesson here is clear: when you're building something transformational, it's better to capture a small slice of massive value than to optimize for short-term revenue. This approach has helped Built maintain a 99.999% client retention rate – nearly unheard of in enterprise software.

Staying Resilient Through Market Changes

Recent market turbulence has tested Built's model. Rising interest rates and economic uncertainty have impacted construction lending. Their average client saw origination volume drop 57% from peak to trough. Yet Built has continued to grow by focusing on risk management and compliance – features that become even more valuable in uncertain times.

This adaptability reveals an important truth about construction technology: the best solutions solve fundamental problems in both good times and bad. Built's platform isn't just about efficiency – it's about giving stakeholders the visibility and control they need to make better decisions in any market condition.

What This Means

For founders in construction technology, Built's story offers several key lessons. Start by solving problems at systemic chokepoints where improvement creates cascading benefits. Focus on measuring and proving value creation. Build for the long term while showing early wins.

Contractors should prepare for continued digitization of financial processes. The days of paper checks and manual draw requests are numbered. Banks and lenders increasingly expect digital workflows and real-time project visibility. Getting ahead of these changes can create competitive advantages in securing project financing.

For corporate leaders, Built's success highlights the importance of looking beyond point solutions. The real value often lies in platforms that can improve core business processes while providing better risk management and visibility. Focus on solutions that can scale across your organization and improve key stakeholder relationships.

Looking Forward

Built Technologies isn't done innovating. They see their current success as "not even out of the first inning." Their vision extends beyond loan administration to fundamentally transforming how money moves through the construction ecosystem.

This ambitious outlook reflects a broader truth about construction technology: we're still in the early stages of digital transformation. The companies that succeed will be those that solve fundamental problems, create measurable value, and build for the long term. Built Technologies has shown one path to success. The opportunity now is to build on these lessons and create the next generation of solutions that will transform our industry.

Watch the full episode with Chase Gilbert here👇👇👇

WEEKLY MUSINGS

Heuristics, Strategic Silence, India's Tech Surge

Challenging VC orthodoxy

Why you might not hear from the best startups

Global data center race heats up

OUR SPONSORS

BuildVision — streamlining the construction supply chain with a unified platform for contractors, manufacturers, and stakeholders.